The National Minimum and Living Wage Increases are Effective from 01 April 2021 - Guest Article by Ian Holloway

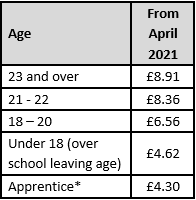

The National Minimum Wage (Amendment) Regulations 2021 comes into force on 01 April 2021. This implements the UK Government accepted recommendations of the Low Pay Commission (LPC) regarding the rates of the National Living and Minimum Wage (NLW and NMW) to apply from April 2021. This is confirmed in the November 2020 Spending Review blue book:

* For apprentices aged 16 to 18 and those aged 19 or over who are in their first year. All other apprentices are entitled to a rate applicable for their age.

The Accommodation Offset daily rate increases from £8.20 to £8.36.

A letter from Bryan Sanderson, Chair of the Low Pay Commission to the Secretary of State says that the rates will apply from 01 April 2021. Indeed, most people that watch a commercial television station will have seen the announcements that the rates will apply from 01 April 2021. This leads our workers to expect that rates will be payable from this date and employers to think the same. However, from a legislative perspective, this is not correct and this misconception is because no television commercial has bothered to explain the pay reference period.

apply from 01 April 2021. Indeed, most people that watch a commercial television station will have seen the announcements that the rates will apply from 01 April 2021. This leads our workers to expect that rates will be payable from this date and employers to think the same. However, from a legislative perspective, this is not correct and this misconception is because no television commercial has bothered to explain the pay reference period.

Regardless of what Gov.UK may say, the new rates are not effective 01 April 2021. They are effective from the first full Pay Reference Period (PRP) that starts on or after Thursday 01 April 2021. Which begs the question….

What is the Pay Reference Period?

To understand it, you need to get the definition of the pay reference period (PRP) which, according to the National Minimum Wage Regulations 2015, is the period of time for which someone is paid:

A “pay reference period” is a month or in the case of a worker who is paid wages by reference to a period shorter than a month, that period.

The date that they are actually paid does not impact the PRP. It is all to do with the period of time that is measured for that payday. For example:

A monthly-paid employee

They will often be paid from the first to the last working day of the month and this is their PRP. In April 2021, the PRP will be 01 to 30 April. The fact that the employee might be paid on, day, 28 April 2021 has no bearing on the PRP, which is still 01 to 30 April.

A weekly-paid employee

Will have a PRP of a week. For example, someone that is paid on Friday 09 April 2021 will often be paid for the week that commences 29 March and finishes Sunday 04 April 2021.

So, what should be paid for the work done in the pay reference period?

Having established what the PRP is, the next step is to determine what the law says about the rate of pay that should be paid in that PRP. The National Minimum Wage (Amendment) Regulations 2016 really help to clarify this in simple terms at point 4B and says that the minimum hourly rate:

‘at which the worker is entitled to be remunerated as respects work in the pay reference period is the rate that applies to the worker on the first day of that period’.

So, referring back to the above examples:

- 01 to 30 April 2021 PRP – the worker must be paid at the rate that applied on the first day of the PRP, i.e. 01 April 2021. The worker is legally entitled to be paid at least the value of the NLW / NMW for the entire period, as 01 April 2021 is the date that the new rates are in force.

29 March to 04 April 2021 PRP – the worker must be paid at least the value of the NLW / NMW in force on the first day of the PRP. This is the rate applicable on 29 March 2021. Legally, the first time that the worker is entitled to be paid at the increased rate is the first full PRP that starts on or after 01 April 2021. This is the PRP that starts Monday 05 April 2021.

However, I would point out that there is absolutely nothing to say that an employer cannot make payment at the rates effective 01 April 2021 rather from the start of the PRP on or after 01 April 2021. I expect there are many employers that will do this in the belief that this is what they are legally obliged to do anyway. From a legal perspective, this is not correct. The rates are in force from 01 April 2021, which is not the same as saying it is effective from this date.

It all depends on the pay reference period.

So:

Are the increased rates payable on 01 April 2021?

Are the increased rates payable on 01 April 2021?

If the PRP starts on or after 01 April 2021, the employer has a statutory obligation to ensure that workers are paid at the new rates. If it starts before 01 April 2021, there is only a statutory obligation to ensure that workers are paid at the previous rates.

Plus:

Is it payable on the date that someone turns 23?

It depends on their age at the start of the PRP. If an employer has a monthly prp 01 – 30 April 2021 and a worker aged 22 turns 23 on 02 April, the only statutory obligation is for the employer to pay at least the value of the NMW. The obligation to pay at the higher NLW does not begin until the start of the next PRP on 01 May 2021.

Ian Holloway is a highly respected payroll practitioner, writer, advisor and trainer. He has worked in the payroll profession for over 30 years and is now Payroll Consultant at i-Realise, an independent change management business operating in the HR & payroll space.

Ian Holloway is a highly respected payroll practitioner, writer, advisor and trainer. He has worked in the payroll profession for over 30 years and is now Payroll Consultant at i-Realise, an independent change management business operating in the HR & payroll space.

Ian has hands-on experience processing payrolls from all sectors, large and small. In 2011 he shifted focus to his passion for educating the profession and also worked on improving payroll software solutions to meet legislative requirements and business goals. He is the Trailblazer Chair for the Level 3 Payroll Administrator Apprenticeship and the Level 5 Payroll Assistant Manager Apprenticeship. He also advises on the practical impacts of new government legislation.

As Payroll Consultant at i-Realise, Ian’s broad experience and up-to-date knowledge allows him to publish insights to UK HR & Payroll professionals through workshops, white papers, newsletters and face-to-face presentations. Ian regularly speaks at industry conferences and is a featured writer for several Payroll, HR and Finance publications. Ian leads i-Realise’s monthly payroll forum, a confidential platform for in-house payroll leaders and managers to discuss new legislation and collectively improve best practice.

You can contact Ian at iholloway@i-realise.co.uk