New Starter Checklists for Tax Year 2021/22 - Guest Article by Ian Holloway

HMRC has issued a new Starter Checklist (and Expat version) to be used from 06 April 2021:

This is issued to new starters who commence employment without producing a P45. Or, in HMRC’s words, ‘a recent P45’. This takes into account that a P45 can be operated by the employer if it is ‘in date’ (i.e., if it is for the current tax year or the one before). A P45 that is not in date is one that cannot be used.

The Starter Checklist

The Checklist requires the new employee without an ‘in date’ P45 to choose one of three statements about their circumstances, all so that the employer can allocate a tax code (statements that I have rephrased below).

- A – ‘This is my first employment since the start of the tax year’

- B – ‘This is now my only employment but I have had another job since 06 April’

- C – ‘I am in receipt of other income via another job or pension’

We allocate the respective tax code and allocate a starter statement in the payroll system which is then reported on the Full Payment Submission (FPS).

HOWEVER

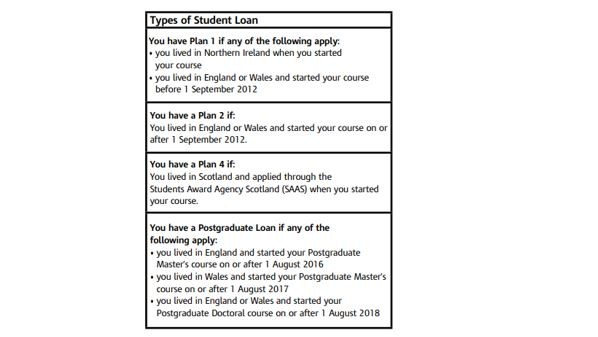

The Starter Checklist is not only important for allocating the tax code. It is vital if the employee starts with an in date P45 indicating that there was a Student Loan in operation at the last employment. The reason for this is to determine which Student Loan deduction will apply. A P45 will only indicate that one was in operation at the last employment. It will not identify whether this is Plan 1, 2 or a PGL.

Plus, from 06 April 2021 we also have to consider that there is Plan 4.

Plan 4 – An Overview

Plan 4 is a Student Loan for borrowers who lived in Scotland and applied through the Students Award Agency Scotland (SAAS) when they started their course – i.e., a ‘Scottish borrower’.

In November 2017, the report ‘Student financial support in Scotland: independent review’ recommended that the repayment threshold was increased to £22,000 – bearing in mind that all Scottish borrowers have Loans amalgamated under Plan 1. On 09 June 2018, First Minister Nicola Sturgeon announced that this would increase to £25,000 instead, effective April 2021. This was confirmed by Shirley-Anne Somerville in a Ministerial Statement on 06 July 2018.

- Plan 4 applies to all new and existing Scottish borrowers from April 2021

- The Starter Checklist (and Expat version) and the SL1 have been revised to accommodate the new Plan 4

- The P45 and the P60 will not change

- Employers will be notified via an SL1 to change a Scottish borrower employee from Plan 1 to Plan 4

- The repayment percentage is the same as other Undergraduate Loan deductions (9%), however, the threshold is £25,000

- Like all Loan types, the deduction will be based on the rules in place (i.e., on NI’able pay with the usual rounding rules)

- There is no requirement to separate Plan 4 from any other Loan on the payslip, with the exception of Postgraduate which should show as a separate deduction

- The data fields remain unchanged from those used for Plans 1 and 2 at the moment (data items 27, 41C, 67 and 192)

- As this will be operated as an undergraduate Loan, the same principle applies and only one can be operated at any one time. However, as Plan 1 is abolished for Scottish borrowers and Plan 2 only applies to English or Welsh borrowers, I would have thought it unlikely that someone could be a Scottish borrower and a borrower from another nation (Plans 1 and 2 in England and Wales and Plan 1in Northern Ireland)

- Plan 4 can operate concurrently with a Postgraduate Loan (remembering that these are only available to English and Welsh borrowers)

The long and the short

Employers should issue the Starter Checklist (or ask the question of ANY new employee) to enable them to determine the correct Student Loan deduction to apply. If the question is not asked, the employer has no option but to default to Plan 1 if the P45 indicates that there was one in operation at the last employment.

From tax year 2021/22, there are four possible Student Loan types:

- Plan 1 (for borrowers other than Scottish ones)

- Plan 2 (for English and Welsh borrowers)

- Postgraduate (for English and Welsh borrowers)

- Plan 4 (for Scottish borrowers)

To summarise, there are two new Checklists to be used from 06 April 2021:

- The Starter Checklist and

- The Expat Starter Checklist

Both are only available at the moment as versions that can be downloaded and printed for manual completion. The online versions that can be completed on screen are not available at the moment but ‘will be added soon’.

Ian has been in the payroll profession for over 30 years, processing payrolls from all sectors, large and small. He moved from hands-on exposure in 2011 to become involved in educating the profession. His wide-ranging experience and up-to-date knowledge ensured he was able to impart this information to UK professionals through course material, social media, newsletters and face-to-face presentations.

Ian has been in the payroll profession for over 30 years, processing payrolls from all sectors, large and small. He moved from hands-on exposure in 2011 to become involved in educating the profession. His wide-ranging experience and up-to-date knowledge ensured he was able to impart this information to UK professionals through course material, social media, newsletters and face-to-face presentations.

Today Ian combines both these and is involved with a vital aspect of the payroll environment, that of working with the software that actually does a lot of the hard work for the profession. He is thrilled to be the Head of Legislation and Compliance at Cintra HR and Payroll Services, who constantly demonstrate their commitment to quality and compliant payroll and HR software, support and payroll services.

Ian approaches education and communication very much from the perspective of how this will impact the software, the employer and the worker. So, whilst the legislation is vital, compliance and effective communication are paramount.

Connect with Ian on LinkedIn