Contractors and Employment Status - Understanding IR35 - Guest Article by Jenefer Livings

In April 2020 changes are coming into force for medium and large companies regarding the way contractors are taxed. This guide considers these changes, focusing on defining “contractor” and making decisions around the employment relationship.

Whilst a review was launched by the Treasury on 7th January 2020 which is due to run until Mid-February, there is no indication from the government of any plans to pause the introduction in April.

Background

HMRC have had difficulty enforcing the complex rules around using contractors and similar people. They are currently looking at off- payroll workers to target perceived tax avoidance.

payroll workers to target perceived tax avoidance.

The new legislation moves the burden of responsibility of evaluation of employment status, meaning that the company responsible for paying the contractor is now also responsible for ensuring the correct tax is paid.

Employment status not only defines the tax to be paid but also the employment rights and protections an individual does or does not have. It should be noted that employment rights are not changed by the size or nature of the employer.

What does this mean for business?

Potentially this means increased costs of using contractors and increased risk from getting it wrong. Companies using contractors will need to look at the employment status of individuals to decide whether IR35 applies. However, getting the tax payment correct does little to protect a company from an Employment Tribunal claim for employment rights.

What is a contractor?

The definition of an employment relationship is where a contract of service exists. This should be clearly defined in writing. However, the written agreement is just one part of the consideration. Definitions of employment status are evolving and have done so for a number of decades as new cases and appeals set precedents.

The definition of an employment relationship is where a contract of service exists. This should be clearly defined in writing. However, the written agreement is just one part of the consideration. Definitions of employment status are evolving and have done so for a number of decades as new cases and appeals set precedents.

So, first, let’s define the contractor for the purpose of this guide. A contractor is someone who is not a worker (not in a contract to provide personal service). They may use titles including freelancer, consultant, self-employed, subcontractor, associate. The name they are using does not create a legal status.

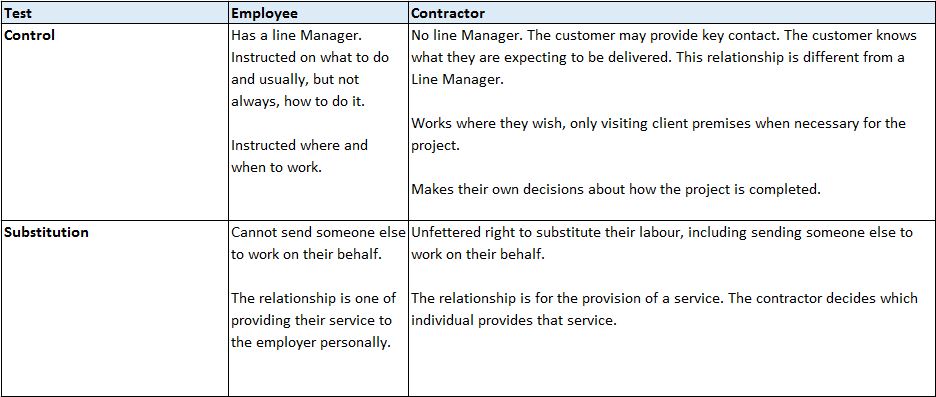

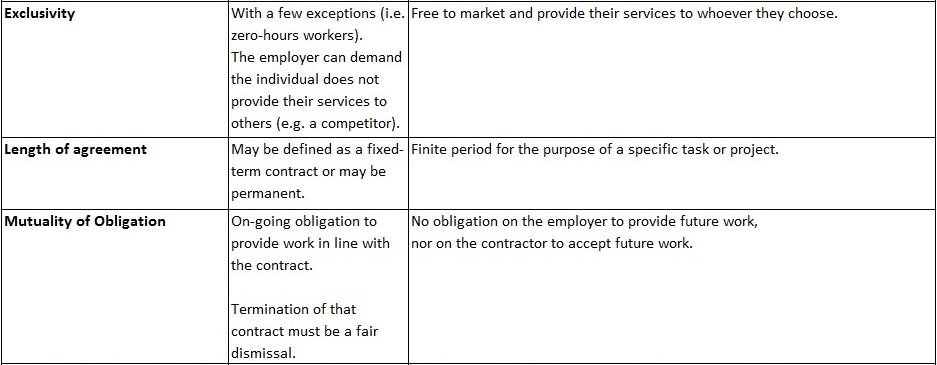

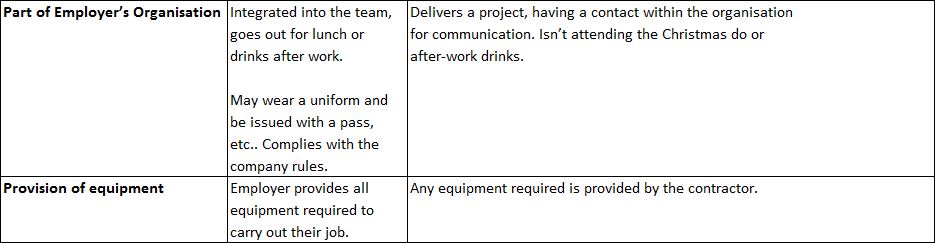

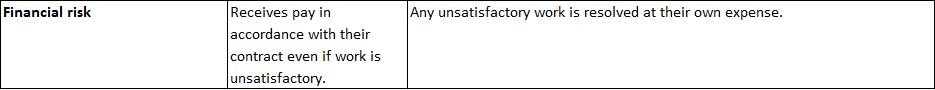

A number of tests have evolved and are detailed below, these are complex. There is no set formula, the judgement is based on the picture as a whole. In many cases professional HR advice will be required to assess employment status.

A written agreement should be in place that reflects the reality of the relationship, whether it is one of employment or business to  business. Both HMRC and an Employment Tribunal would look at the reality of the situation over any written documentation if the written document does not reflect reality.

business. Both HMRC and an Employment Tribunal would look at the reality of the situation over any written documentation if the written document does not reflect reality.

A contractor is your supplier and you are the customer. This is very different from an employment relationship where, to use traditional language, you are their “master”. As a customer, you expect to be presented with a quote for the work to be completed and pay an invoice on the basis of agreed terms.

Getting the employment status wrong for tax purposes risks financial penalties from HMRC. However, getting the tax payments correct or using the title contractor will not necessarily protect a company from an employment tribunal claim. If the individual believes they should be entitled to employment rights (e.g. holiday and sick pay) they can bring a claim to the employment tribunal.

What can we do to prepare?

- Assess the employment status of all your current contractors. Seek advice around those whose employment status is not clear.

- Take advice regarding those falling inside the scope of IR35. Your accountant will be able to advise you on the tax liabilities.

- Ensure your practices and paperwork do not inadvertently create an employment relationship. Getting the paperwork right is one part of this. How you treat people is also crucial.

- Consider different approaches to creating a flexible workforce. We can advise on different types of employment relationships, full time, part-time, fixed term, temporary etc. The options available are endless, call us for advice.

How do we ensure our contractors are not caught by IR35?

- Stop asking contractors for CVs and interviewing them.

- Contracting is a business to business arrangement. You are the customer. Meet with them and find out if their business offering is a fit for your project. Do they provide the service you need at a price you find acceptable?

- Train your Managers because working with contractors means that they need to manage a project as a customer, which is a very different skill to line managing employees.

- Clear communication ensuring both parties understand they are in a business to business relationship and how this will work in reality.

Jenefer runs Silk Helix Ltd, an Essex based HR Consultancy specialising in providing HR support to small businesses. Jenefer is a chartered member of the CIPD with a Masters in Personnel and Development and has worked with small businesses for over 10 years as a consultant with national companies prior to starting Silk Helix. Jenefer is passionate about helping small businesses to get their teams performing, helping them focus their energies on growing their business.